The move is aimed at strengthening India’s semiconductor value chain and reducing import dependence. IT Secretary S. Krishnan confirmed that the framework for the next phase is in place and undergoing internal discussions.

As policy incentives kick in, key players in design, packaging, and AI-driven solutions are poised to benefit. Here’s a look at the companies set to ride this wave.

Izmo

Izmo, a global leader in interactive marketing, specialises in automotive e-retailing, AI-driven analytics, and visualisation technologies across North America, Europe, and Asia.

Its diverse offerings include multilingual web platforms, an extensive automotive image library, and AI-powered decision analytics, catering to a rapidly evolving digital landscape.

The company is on an expansion spree, adding 234 new clients in the US and 43 across Europe and the UK in Q3FY25 alone.

A key driver of this growth is its subsidiary, Izmo Microsystems, which focuses on semiconductor packaging. As one of the few Indian firms offering advanced 3D packaging and system-in-package solutions, it serves over 10 global clients across automotive, aerospace, and renewable energy sectors.

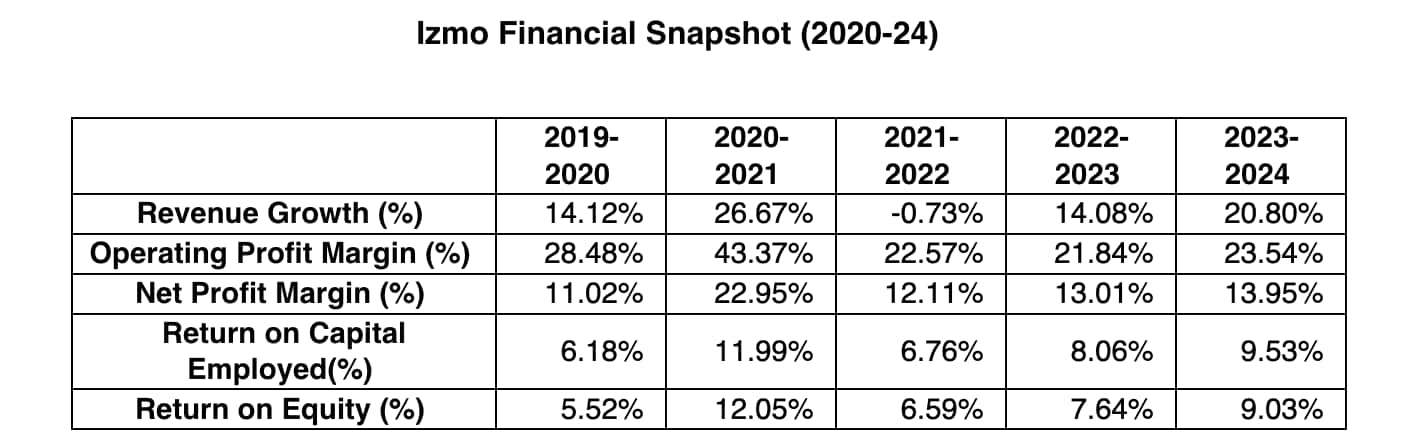

Between 2020-24, Izmo’s sales registered a compounded annual growth rate (CAGR) of 14.6%, while net profit surged by 30.9%. Over the past five years, its return on capital employed (RoCE) and return on equity (RoE) have averaged 8.5% and 8.2%, respectively.

View Full Image

Izmo has been making strategic investments to expand its talent pool and scale semiconductor packaging operations. While these expenditures have impacted margins in the short term, the management remains optimistic about long-term profitability. The company is also strengthening its AI-driven platforms and automotive SaaS solutions to enhance its market presence.

Also read: Unsettling signs emerge for IT investors

With ISM 2.0 driving domestic semiconductor development, Izmo is well-positioned to benefit from policy incentives. Its expertise in AI, digital visualisation, and semiconductor packaging aligns with India’s push for self-reliance in chip manufacturing, reinforcing its leadership in global automotive digitalisation.

L&T Technology Services

LTTS is a niche engineering and R&D services firm specialising in complex design and high-value engineering projects.

Unlike its larger IT peers, the company operates higher up the value chain, focusing on product development, platform engineering, and business transformation services across industries like transportation, industrial products, telecom, and process industries.

View Full Image

The rising demand for digitisation has driven LTTS’ revenue growth in the past few years. Between 2020-24, the revenue grew at a 5-year CAGR of 13.2%, the net profit grew to 12%.

The 5-year average RoCE and RoE stand at 37.2% and 27%, respectively.

LTTS posted a strong Q3 FY25, with 3.1% constant currency growth, driven by its tech and sustainability segments. Large deal bookings hit record levels, including a $50 million deal and multiple $25 million+ deals.

LTTS is scaling its software and digital business, boosted by the Intelliswift acquisition. It is also expanding semiconductor capabilities, emphasising AI-driven automation, 5G, and software-defined vehicles (SDVs).

The company aims to build three billion-dollar segments, targeting $2 billion in revenue with 17-18% Ebit margins, backed by AI frameworks and digital engineering investments.

Also read: Bears arrived at IndusInd months before the bad news broke

LTTS is well-placed to benefit from rising demand for chip design, AI automation, and high-performance computing, leveraging its expertise in networking and embedded systems.

Sasken Technologies

Sasken is a niche engineering services firm specialising in semiconductor design, embedded systems, and communication technologies.

The company provides chip design, system-on-chip (SoC) development and AI-driven solutions for global semiconductor firms. Its expertise spans key industries like telecom, automotive electronics, and industrial automation.

Sasken is expanding its semiconductor and AI capabilities, strengthening offerings in 5G, IoT, and automotive electronics. Demand for its VLSI design and embedded software remains strong, particularly in telecom and high-performance computing.

Over the past five years, Sasken Technologies has experienced fluctuations in its financial performance, with notable declines in both sales and profits.

View Full Image

Near-term, it is investing in AI automation, edge computing, and next-gen semiconductor solutions while expanding partnerships in automotive and industrial IoT.

Long-term, Sasken aims to scale its semiconductor design business and deepen its AI-driven product engineering, positioning itself for sustained growth in India’s evolving semiconductor ecosystem.

Tata Electronics

Tata Electronics operates across the full semiconductor and electronics manufacturing value chain, covering electronics manufacturing services (EMS), semiconductor assembly and test (OSAT), foundry services, and design services.

In the near-term, it’s focused on ramping up its semiconductor assembly and testing capabilities, with an emphasis on reliability and failure analysis. It is also strengthening its design services.

In the longer-term, the company is strategically expanding its global footprint. It has operations in over 17 countries and a talent pool of 65,000. Partnerships with leading global players enhances its competitiveness in semiconductor and electronics manufacturing.

Tata Electronics is at the forefront of India’s first commercial semiconductor fabrication facility in Dholera, Gujarat. The ₹910 billion facility will be capable of producing 50,000 wafers per month.

While the company isn’t publicly listed yet, it is shaping up to be a critical player in India’s semiconductor landscape.

Also read: Tamil Nadu’s limestone tax: A crushing blow to cement margins?

Conclusion

India’s semiconductor sector is at a turning point, with ISM 2.0 aiming to drive domestic innovation, manufacturing, and supply chain resilience.

As policy incentives expand and chip demand rises, companies mentioned in this article are positioned to benefit. However, the sector remains capital-intensive and subject to execution risks.

Investors should closely track company performance, policy developments, and global semiconductor trends before making investment decisions.

Happy investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com