GameStop shares jumped Monday after CEO Ryan Cohen posted a photo with Strategy co-founder Michael Saylor, fueling Bitcoin-related speculation.

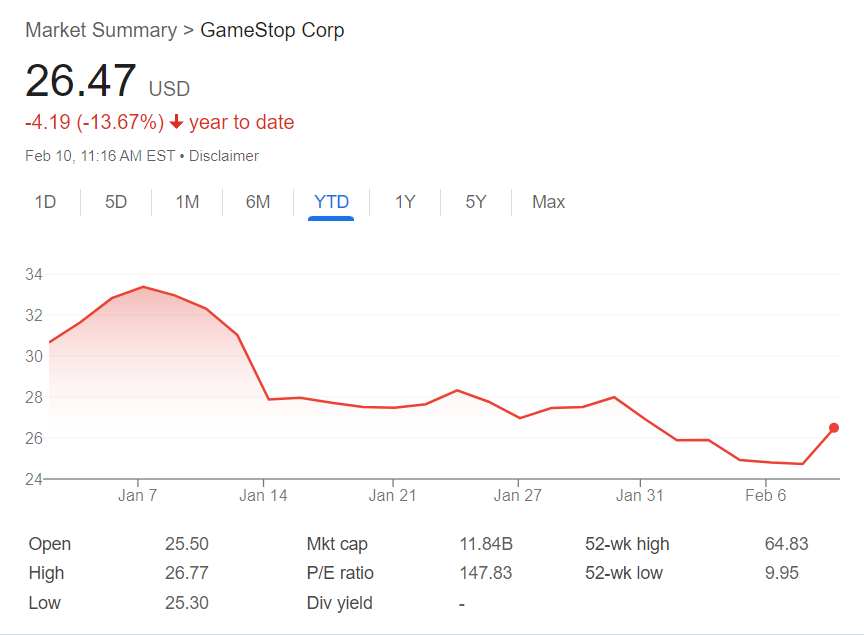

GameStop shares jumped nearly 7% on Monday morning after the firm’s chief executive Ryan Cohen shared a photo with Michael Saylor, co-founder of Strategy (formerly MicroStrategy), on X. As of press time, GameStop (GME) shares are trading at $26.39, up 6.7%, per data from Google Finance.

Cohen’s X post contained no information, leading to speculation that GameStop might be looking into something related to Bitcoin (BTC) as Strategy reignited investors’ interest after it started its buy-spree of Bitcoin. Cohen didn’t reveal why he met with Saylor. GameStop also made no public statements on the matter at the time of writing.

GameStop trying to find positive momentum

Back in 2021, GameStop became a top meme stock when retail traders drove up its price, putting pressure on short sellers. Those who had bet against the stock were forced to buy shares to cut their losses. One of the biggest casualties was Melvin Capital, a hedge fund that had heavily shorted GameStop and ended up losing around $7 billion.

And still, despite Monday’s jump, GameStop’s shares weren’t doing good lately. Data from Google Finance shows GME has been down nearly 14% so far in 2025 as investors remain uncertain about the company’s future given that it has been working to move away from its traditional video game retail business.