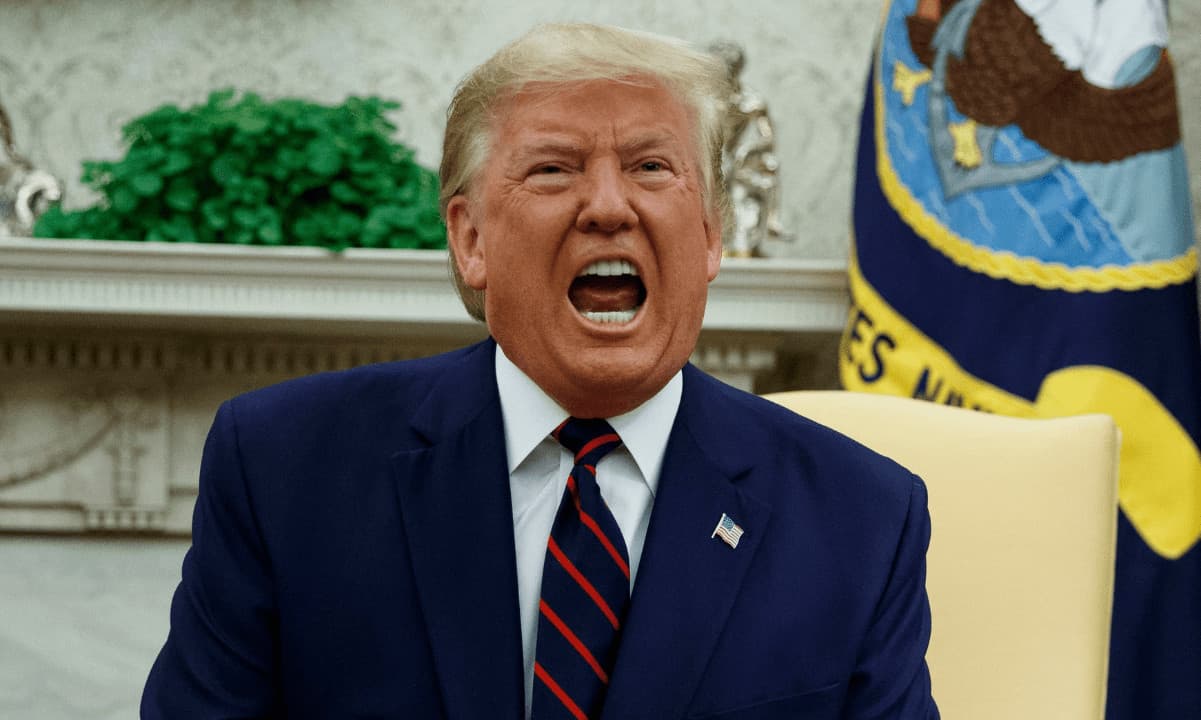

High-risk assets such as tech stocks and crypto have been selling off heavily over the past month or so as Donald Trump’s trade war escalates.

However, this could all be part of a “short term pain” masterplan in a strategy that aims to lower inflation and refinance around $9 trillion of US debt by allowing market weakness, reported the Kobeissi Letter.

“We have seen over $5 trillion erased from US stocks with the goal of lowering rates. Will it work?”

Planned Market Turmoil

The administration appears unified in this approach, with Commerce Secretary Howard Lutnick stating, “Stock market not driving outcomes for this admin,” Treasury Secretary Scott Bessent saying he’s “Not concerned about a little volatility,” and Trump acknowledging a “period of transition” that will “take a little time.”

Elon Musk also appears to support this strategy, saying Tesla stock “will be fine long-term” despite TSLA tanking 40% since the beginning of this year.

It’s very clear what’s happening:

President Trump now believes “short term pain” is his ONLY option to lower inflation and refinance $9+ trillion of US debt.

We have seen over -$5 TRILLION erased from US stocks with the goal of LOWERING rates.

Will it work?

(a thread) pic.twitter.com/QlQYU65AZT

— The Kobeissi Letter (@KobeissiLetter) March 13, 2025

This intentional tanking of markets may be driven by several factors, such as a record government deficit reaching $1.15 trillion in February, a desire to lower oil prices, plans to reduce the US trade deficit through tariffs, and a goal to cut government jobs that have accounted for recent job growth.

Trump’s economic weakness plans appear to have several goals, including lowering inflation (currently 2.8%), oil prices, and interest rates. He also aims to reduce deficit spending, trade deficits, and government inefficiency.

Economist Joe Foudy told Newsweek that this is a “political recognition” before adding:

“If the stock market responds negatively or if we see weaker economic data, Trump needs to get ahead of the narrative. By framing short-term economic downturns as necessary for long-term gains, he is managing expectations.”

“Normally, the Federal Reserve would lower interest rates to stabilize the economy. But if tariffs drive up prices, policymakers may hesitate, fearing rate cuts could fuel inflation,” commented NYU economics professor Lawrence White.

Trump is clearly telling his plans.

He doesn’t care about the stock market or the crypto market.

All he cares about is that interest rates to go down which will definitely cause some short-term pain.

This reminds me of Q4 2021 when Powell was calling for higher rates and… pic.twitter.com/b6SRvNwRf8

— Cas Abbé (@cas_abbe) March 13, 2025

Impacts on Crypto Markets

This “short-term pain” approach could lead to significant market volatility across all asset classes, including cryptocurrencies. As traditional markets experience downturns, investors may reduce exposure to high-risk assets like crypto to cover losses elsewhere or move to cash positions, more so if interest rates increase again.

Market instability could also lead to liquidity issues in crypto markets, potentially causing exaggerated price movements. Crypto might continue following stock market trends in the short term. The market has already declined by around 25% over the past couple of months as $1 trillion has left the space.

In the long term, lowering interest rates could eventually benefit it as an alternative investment when cheap money looks for yields.

Moreover, economic instability might accelerate crypto regulation efforts, which could provide clarity and potentially attract more institutional adoption.

If the strategy affects dollar strength, which has weakened recently, cryptocurrencies could benefit as alternatives to fiat currencies.

Over time, crypto markets could gradually decouple from traditional markets as the sector matures and establishes its own economic cycles, however there is likely to be more pain before any gains.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!