Voltas Ltd expects strong demand in the upcoming summer season despite the high base of last year and expects to continue to outperform the industry. This was a key takeaway from the company’s recently held analyst day meeting.

The management also outlined its growth strategy, with a thrust on maintaining a competitive edge through strong distribution and marketing investments. To tap into the demand, the company is taking various steps such as strengthening partnerships with modern trade outlets and incurring higher advertising spends.

The management believes such steps would help the company maintain its outperformance versus the underlying industry. On a year-to-date basis, Voltas’s volumes are up around 35% versus industry growth of nearly 30%, it added.

Analysts at ICICI Securities Ltd expect Voltas to report 20-25% year-on-year volume growth in air conditioners for Q4FY25, driven by intense heat and strong consumer demand. The company has assured that supply constraints in compressors are under control for now, but any disruption could derail its aggressive growth plans.

At the same time, demand for air coolers—a complementary product—has surged, growing 80-85% in the first nine months of FY25. Voltas sees further upside here and is targeting a 70-80% growth trajectory in the coming years and has made several strategic tie-ups for the same.

The commercial AC segment, too, remains a bright spot, with a 12-15% year-on-year growth in the first nine months of FY25 (9MFY25), expected to sustain a 15-18% CAGR going forward.

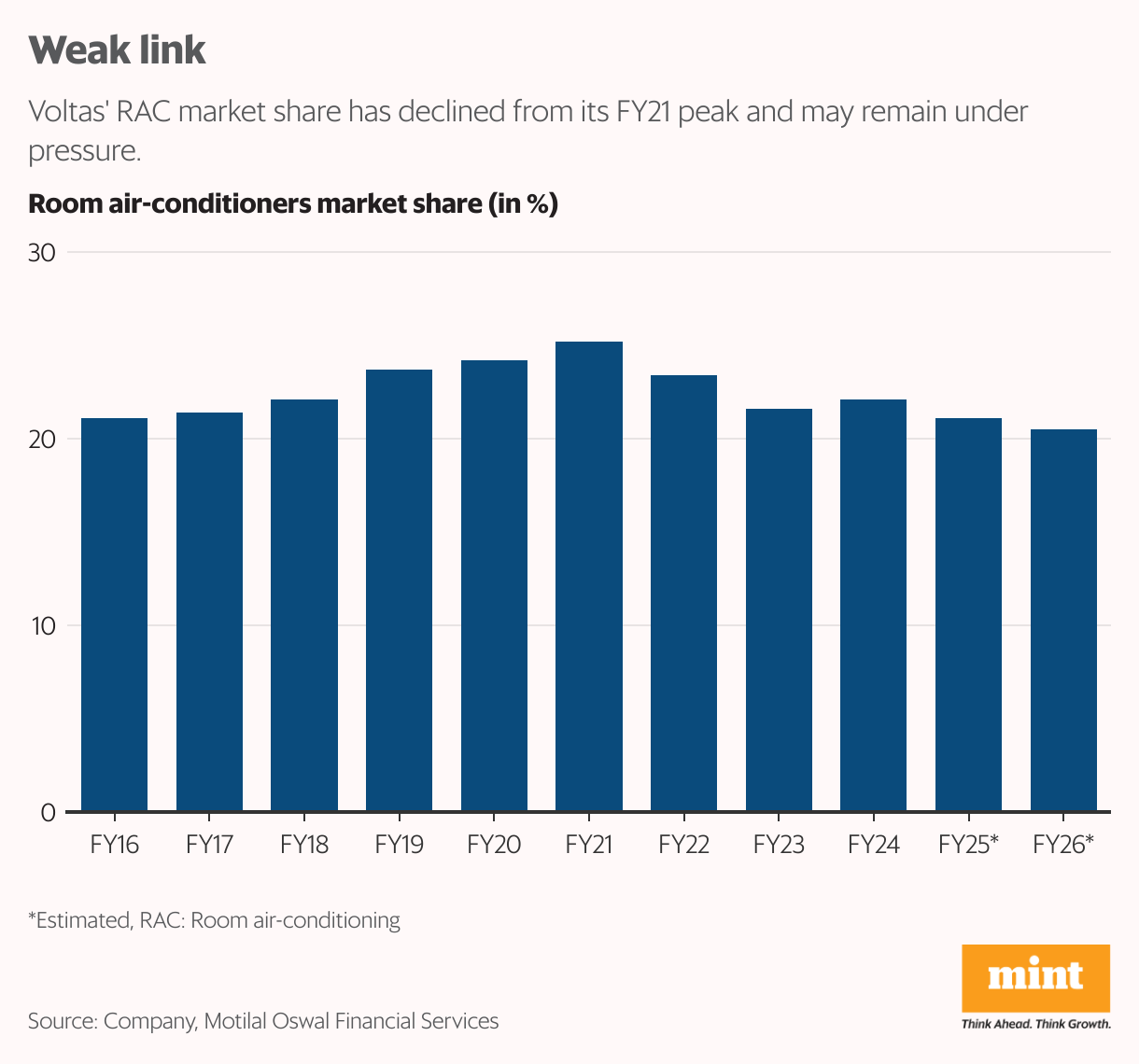

The loss of market share has been a dampener for investors in the Voltas stock. To mend this, the company has refrained from price hikes since mid-2024 as it wants to focus on maintaining its market share. For now, Voltas would prioritise volume growth and market share over immediate margin expansion.

Voltas’ room air conditioner (RAC) market share dipped slightly, ending December 2024 at 20.5% compared to 21% in September, though it improved on a year-on-year basis.

Unlike competitors that have passed on cost inflation through price hikes, Voltas is playing a different game—banking on cost efficiencies and value engineering to protect margins, choosing to chase volumes instead. The bet is that higher sales will more than offset the impact of lower per-unit profitability.

Also Read: Hot summer forecast to boost consumer durables, beverage sales in India

Tricky phase

Voltas is also scaling up production to sustain this push. Its Chennai facility, currently operating at 40-45% capacity, is expected to reach optimal levels only by FY26. Until then, the burden falls on Pant Nagar, which is already running at full capacity. This leaves the company navigating a tricky phase—ramping up output while ensuring supply chain stability.

Complicating matters further is the government’s evolving stance on compressor imports. While the recent relaxation of norms for compressors above 2 tons offers some relief, the bulk of the market—compressors below 2 tons—remains in limbo. Voltas is scouting for alternative sourcing strategies to keep production on track ahead of peak summer demand.

Beyond air conditioners, VoltBeko remains a work in progress. While the JV has gained ground in semi-automatic washing machines, scaling up fully automatic models and refrigerators—key to profitability—will need sustained investment. The FY26 breakeven target now looks uncertain.

Meanwhile, the stock has tumbled over 26% from its 52-week high of ₹1944, seen on 20 September 2024, reflecting investor concerns over market share losses. A meaningful recovery depends on how well the company defends margins and navigates competitive pressures. For now, it’s a volume game, but if profitability remains under stress, sentiment could turn quickly.