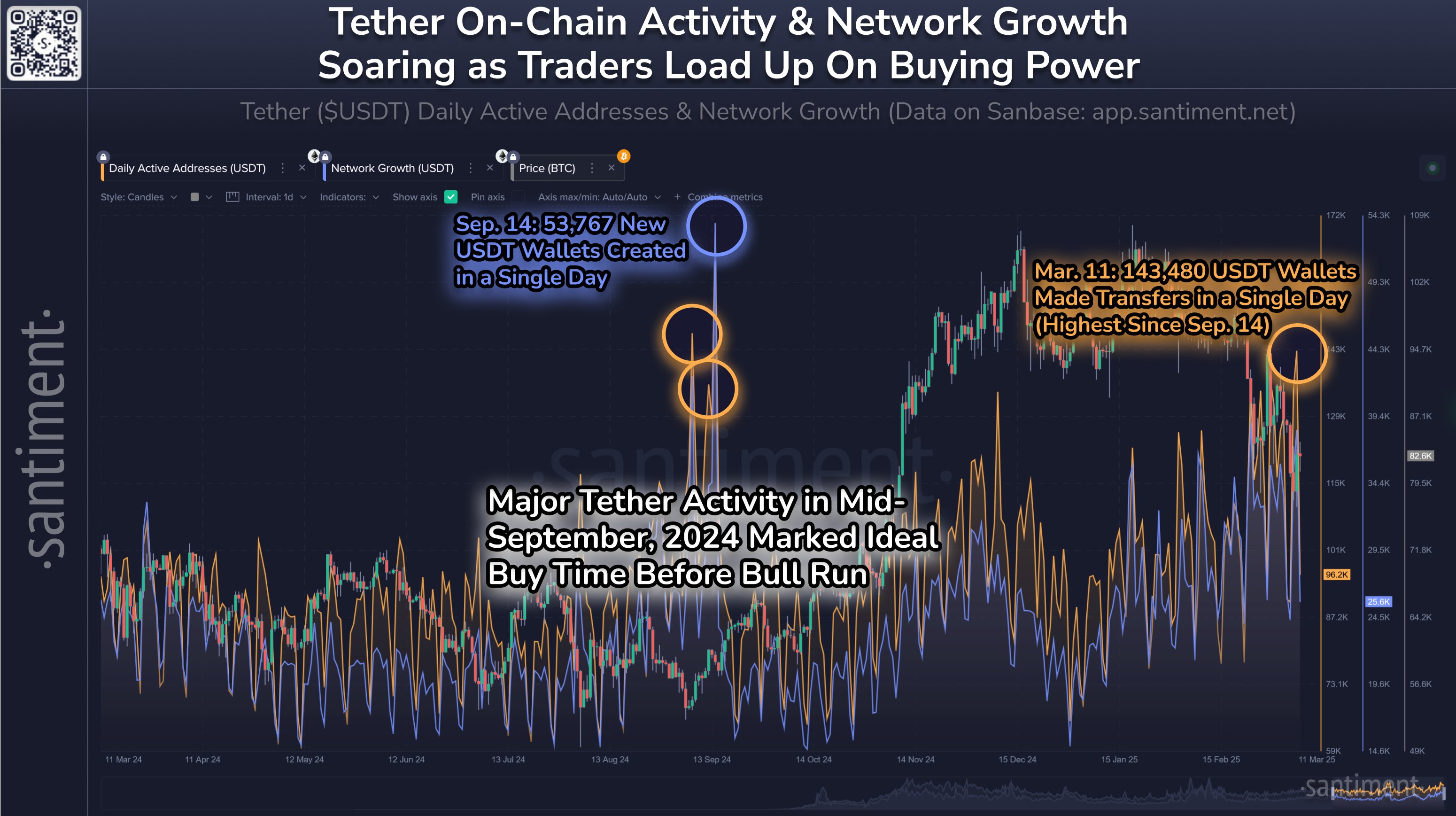

Tether has witnessed a significant surge in on-chain activity in recent weeks, which could signal potential buying pressure following the latest crypto dip.

Market intelligence platform Santiment says on-chain data related to Tether (USDT) points in this direction.

In particular, analysts at the on-chain and social metrics monitoring platform believe a spike in USDT volume indicates a shift in trader dynamics as they look to pounce on the available opportunity.

In the market, major price drops often see traders retreat to top stablecoins, using the loaded-up buying power to flock into Bitcoin (BTC) and other top coins when the opportunity arises. Data Santiment has collated shows USDT recorded a six-month high for the number of wallets making transfers in a single day.

“Tether’s on-chain activity has been rapidly rising, with over 143K wallets making transfers yesterday alone (a 6-month high). When $USDT & other stablecoin activity spikes during price drops, traders are preparing to buy,” the platform posted on X.

According to the analysts, the rise in buying pressure has often aided the crypto market’s recovery. Mainly, this is because during sell-offs, stablecoins such as USDT and USDC (USDC) come in handy. Traders worried about potential dumps often cash out, taking stablecoins as potential store-of-value assets. When sentiment flips, these offer an opportunity to scoop up profitable deals.

With BTC and altcoins experiencing huge losses amid broader risk-off sentiment, Tether’s on-chain activity has soared. The daily active address count and network growth over the past week mirror Tether activity in mid-September, Santiment noted.

On September 14, for instance, Tether saw the creation of 53,767 new wallets in one day. The overall surge aligned with the “ideal buy time before the bull run” that saw Bitcoin go on to hit an all-time high above $109k.

Could the 143,480 USDT wallets that undertook transfers on March 11, 2025, portend a similar scenario?