Flagship programmes like Bharatmala Pariyojana and the National Highway Development project have played a crucial role in this transformation, with thousands of kilometres of highways built every year. In 2023-24 alone, 12,349 km of highways were completed, averaging 33.83 km per day.

This infrastructure push isn’t just about connectivity—it’s a massive opportunity for companies involved in road construction.

With projects worth thousands of crores in the pipeline, the roads and highways sector remains a key driver of economic activity.

But which companies are leading the pack?

In this article, we rank five major road and highway players in India based on their order book, giving investors a clearer picture of who’s best positioned to ride this infrastructure boom.

Out of all the roads and highway stocks listed in the Indian stock market, these five companies have the highest order books at present.

Take a look…

#1 H.G. Infra Engineering

H.G. Infra has built a reputation for executing large-scale infrastructure projects with precision. The company specializes in EPC and Hybrid Annuity Model (HAM) projects, focusing on roads, highways, railways, metro and solar infrastructure.

As of December 2024, H.G. Infra boasts an order book of ₹11,200 crore, providing strong revenue visibility. Roads and highways remain its dominant segment, benefiting from the government’s continued infrastructure push. The company has also expanded into railways and metro projects, tapping into fresh growth opportunities.

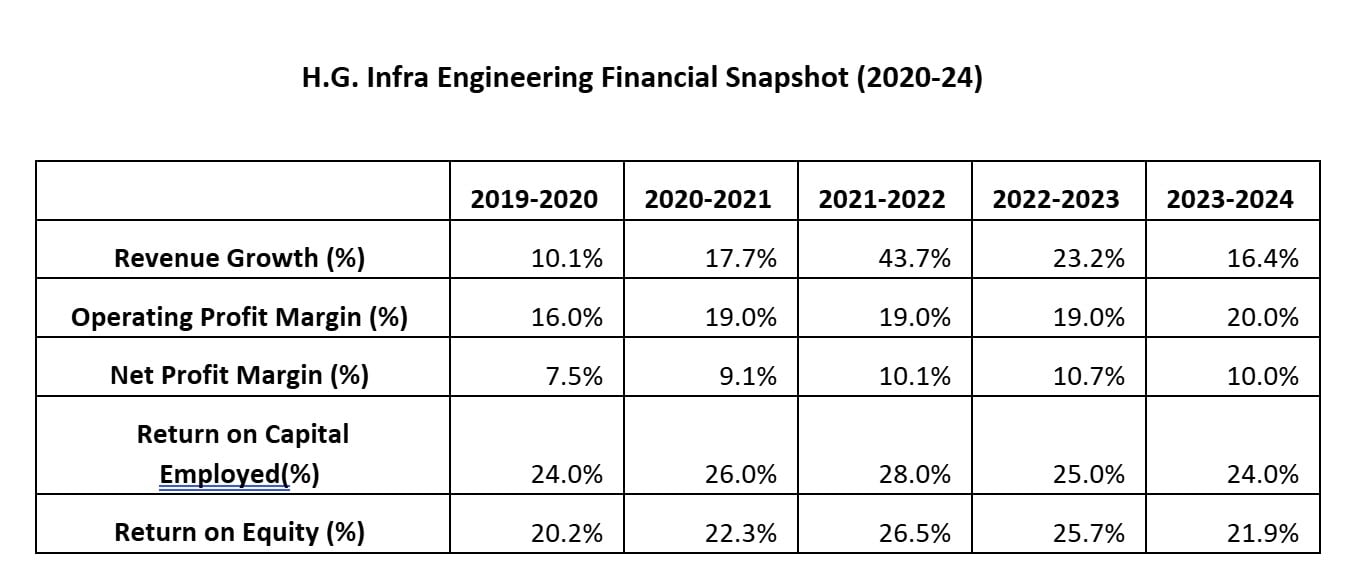

Between 2020 and 2024, sales and net profit reported a 5-year CAGR of 21.7% and 33.4%, respectively. The company’s 5-year average return on equity (RoE) and return on capital employed (RoCE) stood at 26.1% and 23.3%, respectively.

View Full Image

Looking ahead, the company remains optimistic about order inflows, particularly in the roads and expressway segment, where it sees strong bidding momentum. Management expects robust execution in the coming quarters, with a focus on timely project completion.

While diversifying into new infrastructure segments like metro and solar, roads will continue to be the core business.

However, challenges like land acquisition delays, rising competition and high working capital requirements could impact margins. That said, the company’s strong track record, operational efficiency and expanding portfolio position it well for sustained growth.

#2 PNC Infratech

PNC Infratech is a leading infrastructure player with expertise in expressways, highways, bridges, airport runways and water supply projects.

The company provides end-to-end infrastructure solutions, covering HAM, engineering, procurement and construction (EPC), design, build, finance, operate and transfer (DBFOT).

With a strong execution track record, it has built a reputation for timely delivery of large-scale projects across India.

As of December 2024, PNC Infratech’s order book stands at ₹8800 crore, primarily driven by highway and expressway contracts. The company has also secured major projects in Maharashtra and expects further order inflows before the fiscal year-end. While roads remain its core segment, diversification into water and area development projects is also contributing to growth.

On financials front, the company has done well in the past five years, with sales and net profits growing at a CAGR of 18.4% and 21.6%, respectively. The RoCE and RoE have registered a 5-year average of 16.7% and 17.3%, respectively.

View Full Image

The outlook going forward looks positive, with ₹13,000-15,000 crore in new orders expected for FY26. After a slow 2024 due to elections and land issues, activity is picking up and PNC is well-placed for upcoming tenders. Execution of Maharashtra projects will drive revenue, but working capital remains a key watch, especially in the water segment with delayed receivables.

With a strong order pipeline and execution focus, PNC Infratech is eyeing a solid FY26. Order wins and execution pace will be key growth drivers.

#3 Adani Enterprises

Adani Road Transport (ARTL), a subsidiary of Adani Enterprises, is a key player in India’s infrastructure development, focusing on national highways, expressways, metro-rail and railway projects.

The company has a significant presence in the build-operate-transfer (BOT) model, with four projects under construction spanning 3,176 lane km. In the HAM segment, it is executing four projects covering 827 lane km, reinforcing its role in India’s expanding road infrastructure.

For the nine months ended December 2024, ARTL reported ₹72,00 crore in revenue, reflecting strong execution across its portfolio. ARTL is working on major projects, including the Ganga Expressway and multiple BOT, HAM and TOT model roads. The company continues to expand aggressively, aligning with government-led infrastructure initiatives.

Construction activity picked up significantly in FY25, with road execution increasing nearly fivefold compared to the previous year.

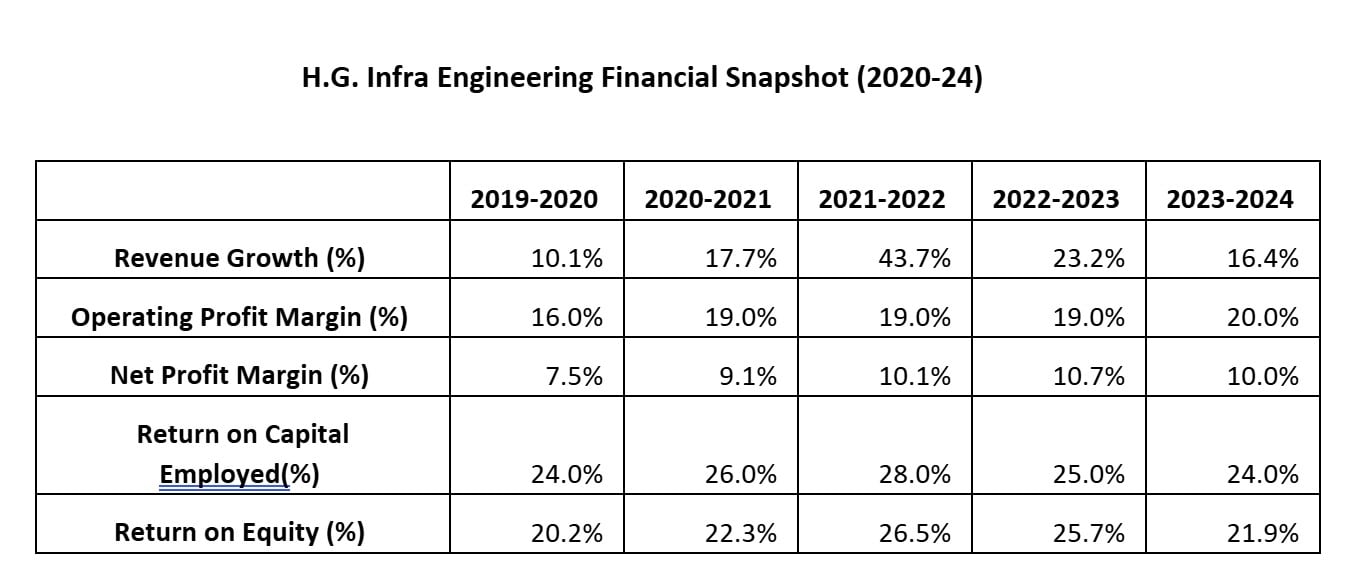

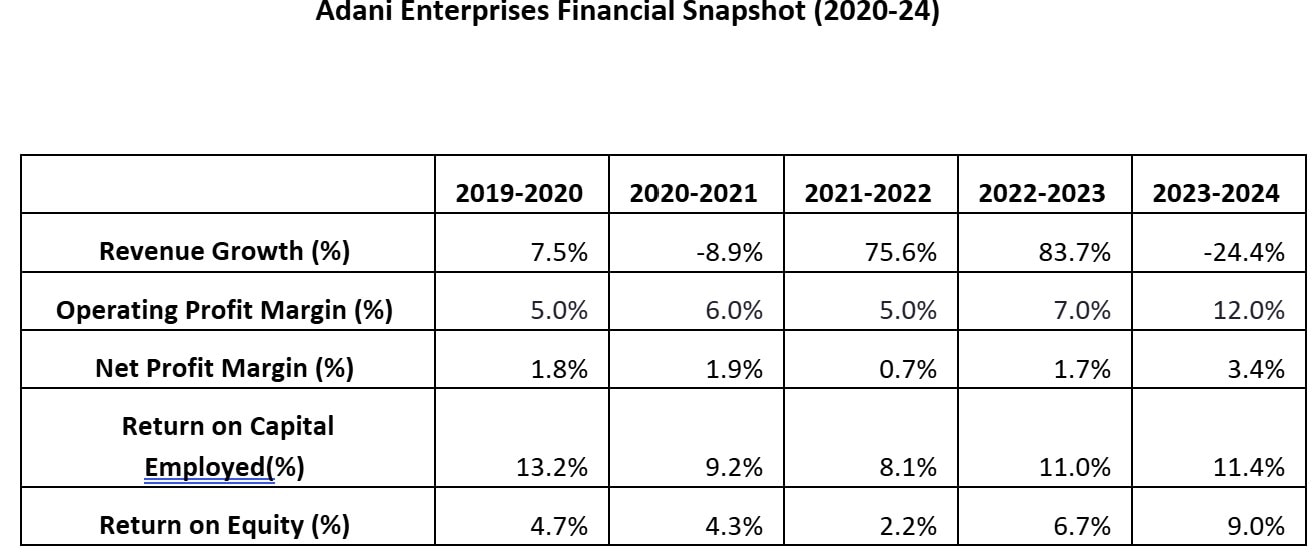

Coming to its financials, between 2020 and 2024, the Adani group company’s sales and net profits registered a CAGR of 19% and 71.3%, respectively. The returns have also been rangebound, with the RoCE and RoE averaging a solid 10.6% and 5.4% over a 5-year period.

View Full Image

Looking ahead, ARTL remains optimistic about project awards under the National Highways Authority of India (NHAI) and the Ministry of Road Transport and Highways (MoRTH), with a focus on expressways and high-traffic corridors.

Management expects robust cash flows from existing TOT and HAM projects, while new tenders provide additional growth levers.

However, capital intensity remains a key risk and timely financial closures will be crucial. With strong execution capabilities and Adani’s backing, ARTL is set to play a larger role in India’s transport infrastructure.

#4 KNR Constructions

KNR Constructions (KNRCL) is a leading infrastructure player with expertise in EPC services across roads, highways, irrigation and urban water infrastructure.

The company has executed large-scale road projects independently and through joint ventures. It has a strong presence across multiple states, handling key highway and expressway contracts.

As of December 2024, KNRCL’s order book stands at ₹5,500 crore, with 46% from roads and highways, 26% from irrigation and 28% from pipeline projects.

The company has ongoing highway projects under HAM and EPC contracts, with physical progress exceeding 80% in key projects like Magadi to Somwarpet and Ramanattukara to Valanchery.

Between 2020 and 2024, the company reported a 5-year CAGR of 14.1% in sales and an impressive 23.2% in net profit. Its returns remain strong, with average RoCE and RoE exceeding 22% and 17%, respectively.

View Full Image

The future outlook remains steady, with KNRCL targeting ₹8,000-10,000 crore in new orders over the next few months.

The company is actively bidding for highway, irrigation and mining contracts, while also exploring BOT toll projects in partnership with larger players like Adani and Cube Highways.

However, order inflows have been subdued in the past year and FY26 revenue is expected to dip by 10-15% due to slower project execution. Irrigation receivables, especially from Telangana, remain a concern, but asset monetization efforts could support cash flows.

With a strong track record in infrastructure execution and disciplined financial management, KNRCL is well-placed to benefit from India’s road expansion push, provided it secures fresh project wins in the coming quarters.

#5 Welspun Enterprises

Welspun Enterprises is an infrastructure developer with a diverse portfolio spanning roads, water and wastewater management.

The company follows an asset-light strategy, focusing on project management, execution efficiency and value creation. It has a track record of delivering complex projects ahead of schedule, including the Delhi-Meerut Expressway and the Ganga River extradosed bridge.

Over the years, Welspun has expanded beyond roads into water infrastructure, tunneling and urban development, making it a well-diversified player.

As of December 2024, Welspun Enterprises’ order book stands at ₹1,700 crore in roads and highways, with a total consolidated order book of ₹14,500 crore.

The company has strategically shifted focus towards water and tunnelling, which now account for a larger share of its portfolio.

While roads remain an important segment, Welspun is leveraging its expertise to bid selectively for projects under BOT, HAM and EPC models.

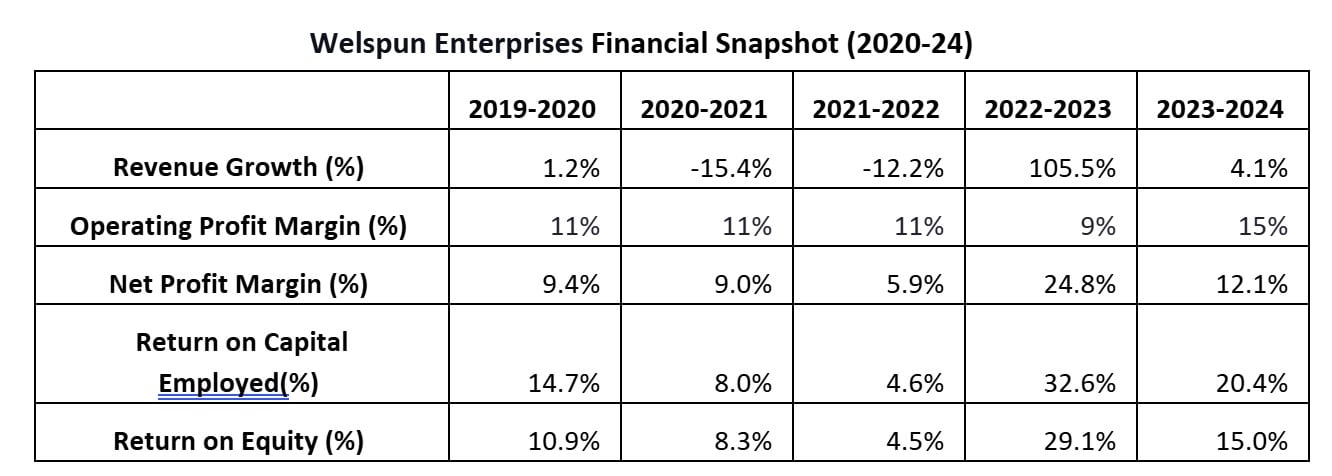

Coming to its financials, between 2020 and 2024, the company reported a 5-year CAGR of 10.8% in sales and an impressive 19.6% in net profit. Its returns remain strong, with average RoCE and RoE exceeding 16.6% and 13.2%, respectively.

View Full Image

The outlook for Welspun remains strong, with ₹8,000-10,000 crore in new orders targeted for FY26, mainly in water, wastewater, and transportation. Roads and highways will contribute 35% of inflows, with the rest from water infrastructure.

Execution of road projects is on track, and the company is eyeing expressway and tunnel contracts under NHAI. Asset monetization continues with successful divestments.

While disciplined capital allocation helps, rising competition in water and longer receivable cycles may impact cash flows. With an asset-light model, cash reserves, and a diversified portfolio, Welspun is well-placed for India’s infrastructure growth.

In Conclusion

India’s road sector is set for strong growth backed by government spending and private investment.

While the five key players mentioned above stand to gain from robust order books, IRB Infrastructure and Dilip Buildcon are also in the mix—but not without risks.

High promoter share pledging though raises concerns, as stock declines could trigger forced sales. Execution challenges, funding constraints and stiff competition from NHAI add to the pressure.

Investors must watch order inflows, financial discipline, corporate governance of the underlying company and their execution speed to navigate this high-stakes sector.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com