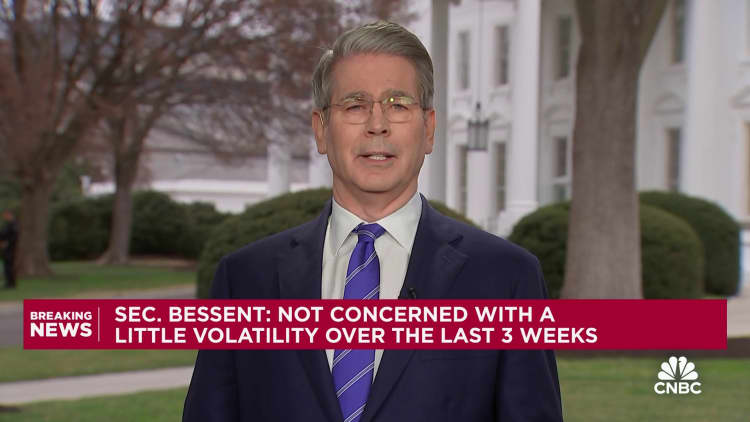

Market observers worry there’s more ugliness ahead, even if stocks are due for a bit of a comeback rally. Stocks continued their sell-off this week, with the S & P 500 briefly dipping into correction territory at one point in a move that could mean that Wall Street is due for a near-term bounce . While the broad market index ended Wednesday higher, the declines resumed on Thursday. In fact, as of midday Thursday, all three of the major averages were on pace for week-to-date losses of more than 4%. Investors, troubled by the current market setup, worry that there’s only more selling ahead. They worry the lack of clarity around trade policy, growing economic uncertainty and the rising federal deficit are raising the potential for a recession — a scenario that is not at all priced into markets. “The market today, from our assessment, especially the fixed income credit market, is not pricing in significant policy downside from here,” Vishal Khanduja, head of broad markets fixed income at Morgan Stanley Investment Management. “It’s pricing in the uncertainty, the heightened volatility is getting priced in, but it’s not pricing in significant downside from a growth perspective, from policy.” “There could be that tail risk that policy is not properly implemented in the right period of time, and it has a big, significant growth downside that the market will react to,” Khanduja said. “So, that definitely is not yet priced in.” To be sure, broadly speaking, investors do not hold a recession in their base case for 2025, given the strength they see in household balance sheets. However, many are reducing their exposure to U.S. stocks, and adding to safe haven assets such as Treasurys and gold, as uncertainty roils markets. Here is a rundown of the market’s biggest preoccupations. Trade Tariffs are the hinge point by which the market outlook has turned for the worse. In the immediate aftermath of the November election, stocks surged to all-time highs as investors expected President Donald Trump’ s focus on deregulation and lowering taxes would offset any harm done by tariffs. In a note, Alpine Macro’s chief geopolitical strategist Dan Alamariu said he viewed Trump’s policies as “benign” coming into the year, before the balance “rapidly shifted.” Now, with an escalating trade war with Canada, as well as further conflicts with Mexico, China and Europe, the ongoing uncertainty around tariffs has consumers and companies paralyzed, potentially slowing spending. This could dent corporate profits going forward. Airlines such as Delta , American and Southwest cut their first-quarter estimates, warning of the impact of a weaker economic backdrop on travel demand. Elsewhere, retailers such as Kohl’s and Dick’s Sporting Goods said they expect a rough 2025 , given falling consumer confidence. “More clarity from the fiscal policy side would be critically helpful,” Morgan Stanley’s Khanduja said. Growth Reports of weaker consumer confidence also spell trouble for the U.S. economy ahead, a worry that will have investors scouring economic data for signs of an impending recession. “I think in the next eight to 12 weeks, the data cycle here in the U.S. is going to be very important,” Morgan Stanley’s Khanduja said. “We’ve seen some of the survey level data showing the weakness, but we want a little bit more confirmation from harder data, or fundamental data.” The retail sales report, which is set to be released Monday, will be among the first data points to show whether consumer spending is contracting. That could confirm the recent warning flags from CEOs. Deficit spending Wall Street will also pay close attention to any ongoing developments on the U.S. federal deficit, closely following comments from Treasury Secretary Scott Bessent and other officials for clues into how they plan to address the deficit. For fiscal 2025, the deficit totaled $1.15 trillion through the first five months, roughly $318 billion, or 38%, more than during the same time span in 2024. That’s a record for the period.