By Stephanie Kelly and Arunima Kumar

NEW YORK -Oil prices rose 2% on Wednesday, as U.S. government data showed tighter-than-expected oil and fuel inventories, though investors kept an eye on mounting fears of a U.S. economic slowdown and the impact of tariffs on global economic growth.

Brent futures settled $1.39, or 2%, higher at $70.95 a barrel. U.S. West Texas Intermediate crude futures gained $1.43, or 2.2%, to $67.68 a barrel.

U.S. crude stockpiles rose by 1.4 million barrels in the latest week, U.S. government data showed on Wednesday, which was less than the 2-million barrel rise forecasters had expected.

U.S. gasoline inventories fell by 5.7 million barrels, versus expectations for a 1.9 million-barrel draw, while distillate stocks also dropped by more than expected.

“This week, the oil build was smaller than expected and gasoline and diesel draws were larger than expected,” said Josh Young, Chief Investment Officer, Bison Interests. “This evidences stronger demand and could see oil prices rise as a result.”

In recent days, crude futures have been supported by a weaker U.S. dollar and the Energy Information Administration moving away from earlier calls of strongly oversupplied oil markets this year, said UBS analyst Giovanni Staunovo.

The dollar hovered near a five-month low against other major currencies, as traders digested tit-for-tat U.S.-EU tariffs and a potential Russia-Ukraine ceasefire.

The dollar index, which fell 0.5% to fresh 2025 lows on Tuesday, boosted oil prices by making crude less expensive for buyers holding other currencies. [USD/]

However, signs of cooling inflation offered investors some respite after U.S. consumer prices increased less than expected in February. Still, U.S. President Donald Trump’s aggressive tariffs on imports are expected to raise the costs of most goods in the months ahead. Some have taken effect and others have been delayed or are set to kick in later.

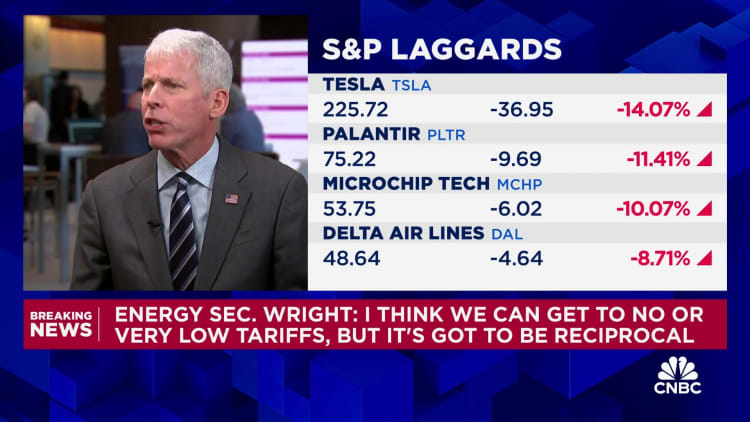

Markets worry that tariffs could raise prices for businesses, boost inflation and undermine consumer confidence in a blow to economic growth.

“Fears of a U.S. recession, weakness in U.S. stock markets and concerns over tariffs affecting key oil players such as China, introduced additional market uncertainty and these factors could continue to fuel a bearish sentiment, putting a lid on oil prices,” said Hassan Fawaz, chairman and founder of brokerage GivTrade.

Also on Wednesday, the Organization of the Petroleum Exporting Countries kept its forecast for relatively strong growth in global oil demand in 2025, saying air and road travel would support consumption.

“Trade concerns are expected to contribute to volatility as trade policies continue to be unveiled. However, the global economy is expected to adjust,” OPEC said in the report.

OPEC also published figures showing a 363,000 bpd increase in production by the wider OPEC group in February, led by a jump in Kazakhstan which is lagging in its adherence to OPEC output quotas.

This article was generated from an automated news agency feed without modifications to text.

Catch all the Business News , Market News , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess