Litecoin price has crashed into a bear market this year, and technicals suggest that it has more downside to go even as whale activity increases.

Litecoin (LTC) was trading at $93.80 on Friday, down 36% from its highest level this year and just above this month’s low of $83.33.

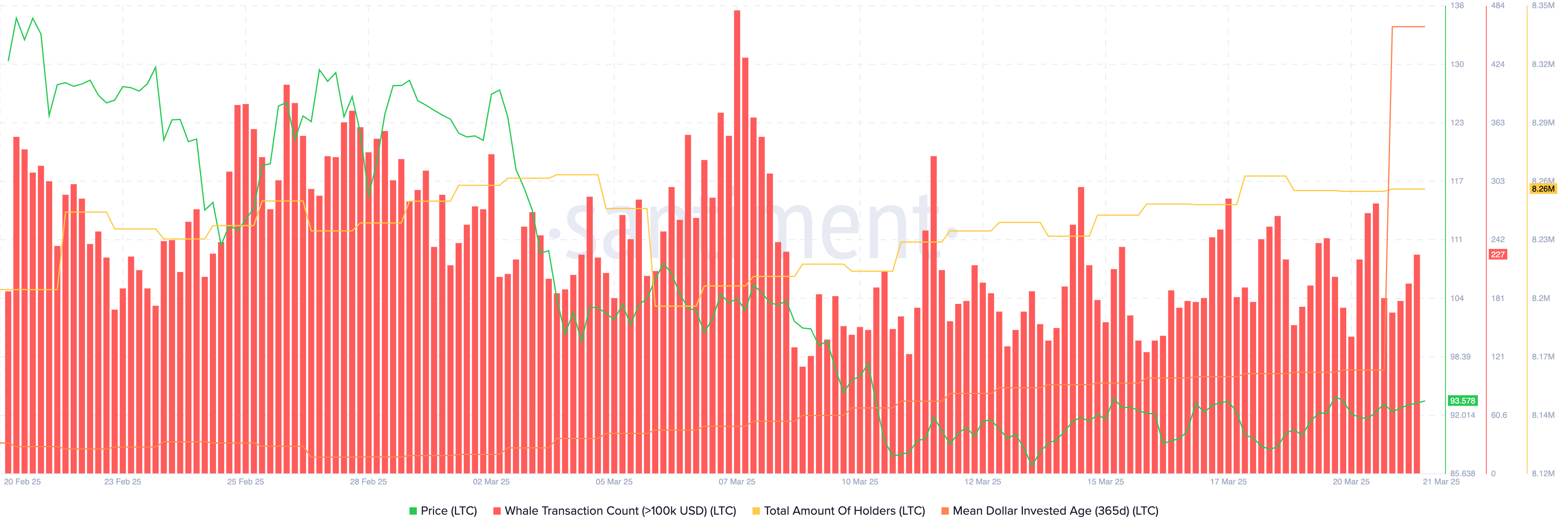

On-chain metrics are painting a mixed picture of Litecoin. On the positive side, the total amount of holders has held steady at 8.6 million in the past few days.

The number of whale transactions on the network has also grown this week. Whale transactions jumped to 227 on Friday, up from 167 earlier in the week. This suggests that sophisticated investors are buying the coin, anticipating a price rebound.

Another key metric is the 365-day mean dollar invested age, which estimates how long a coin has remained in its current address and calculates the average age of the money used to buy it. Litecoin’s MDIA indicator has surged to 600, up from 500 earlier this year—a sign of increasing holder accumulation.

A likely reason for this whale and user accumulation is a sign that investors anticipate that the coin will bounce back if the SEC approves a spot LTC ETF. It is also happening as investors theorize that Litecoin is cheap, considering that the Z score of the Market Value to Realized Value or MVRV has dropped to the lowest level in months. A falling MVRV indicator is a sign that an asset is cheap.

Litecoin price technical analysis

The daily chart shows that LTC has plunged below the critical support at $112.50, the highest swing in March 2024. Litecoin has formed a rising wedge pattern, consisting of two ascending and converging trendlines. It has also created a bearish flag pattern, which is a popular continuation sign.

Litecoin has additionally formed a mini death cross pattern as the 50-day and 100-day moving averages have crossed each other. This increases the likelihood of a bearish breakdown despite encouraging on-chain metrics. If this happens, the key level to watch will be $80, its lowest point in 2025.