With regulatory approvals secured, the company is set to hit the public markets soon, though the exact timing remains uncertain. More than just a capital-raising event, this IPO is part of LG’s larger play to capture India’s booming consumer market while addressing the so-called “Korean discount”—a valuation gap that often leaves South Korean firms trading at lower multiples than their global peers.

Read this | Why Hyundai’s IPO may have disappointed and what’s next?

But will this strategy pay off for Indian investors? Will LG’s dominance in consumer electronics translate into attractive returns, or is the valuation already stretched?

Let’s break down the details.

LG India’s IPO: Key details

LG India aims to raise between $1 billion ( ₹8,650 crore) and $1.5 billion ( ₹13,000 crore), potentially valuing the company at around $15 billion ( ₹1.3 trillion), based on an exchange rate of ₹86.5 per US dollar.

If successful, it would rank among India’s largest IPOs, alongside Hyundai ( ₹27,870 crore), LIC ( ₹20,557 crore), Paytm ( ₹18,300 crore), and Coal India ( ₹15,199 crore).

The IPO will be an offer for sale (OFS), with LG Electronics offloading up to 10.18 crore equity shares—roughly a 15% stake. Since there is no fresh issue, all proceeds will go to the parent company, and LG India itself will not receive any capital from the listing. LG expects the IPO to enhance brand visibility and reinforce its market leadership in India.

LG, a dominant player in India’s consumer electronics market

India is LG’s second-largest market after the US, and the company dominates the country’s home appliance and consumer electronics segment in both volume and value.

Read this | This smallcap pipe stock is down 61% in last one year. Can Q4 spark a comeback?

It holds the leading market share across all major product categories, including washing machines, refrigerators, inverter air conditioners, microwave ovens, and water purifiers. With a 33.5% share in washing machines, 28.7% in refrigerators, 19.4% in inverter air conditioners, 45.8% in microwave ovens, and 42.7% in water purifiers, LG is the only company with a leadership position across all these segments.

This dominance is reinforced by an extensive distribution network, comprising 777 exclusive LG outlets, 1,266 modern retail stores, 1,218 multi-brand outlets, and 31,291 sub-dealers as of June 2024. The company manufactures nearly all of its products in India, contributing significantly to the Make in India initiative.

However, it continues to depend on both domestic and foreign suppliers for raw materials, sourcing 51.1% from outside India while aiming to increase local procurement.

LG operates two manufacturing units with a total installed production capacity of 1.39 crore units. To further expand its capacity, it is considering setting up a third facility in Andhra Pradesh, for which it has proposed an investment of ₹7,000 crore. Keeping manufacturing in-house allows LG to optimize costs, particularly in supply chain management, enabling it to maintain competitive pricing.

Read this | Electronics manufacturing firms tipped to outperform indices this year

Its strong production efficiency is reflected in a high-capacity utilization rate of 71% in FY24, underscoring sustained demand for its products.

Financials: LG India vs peers

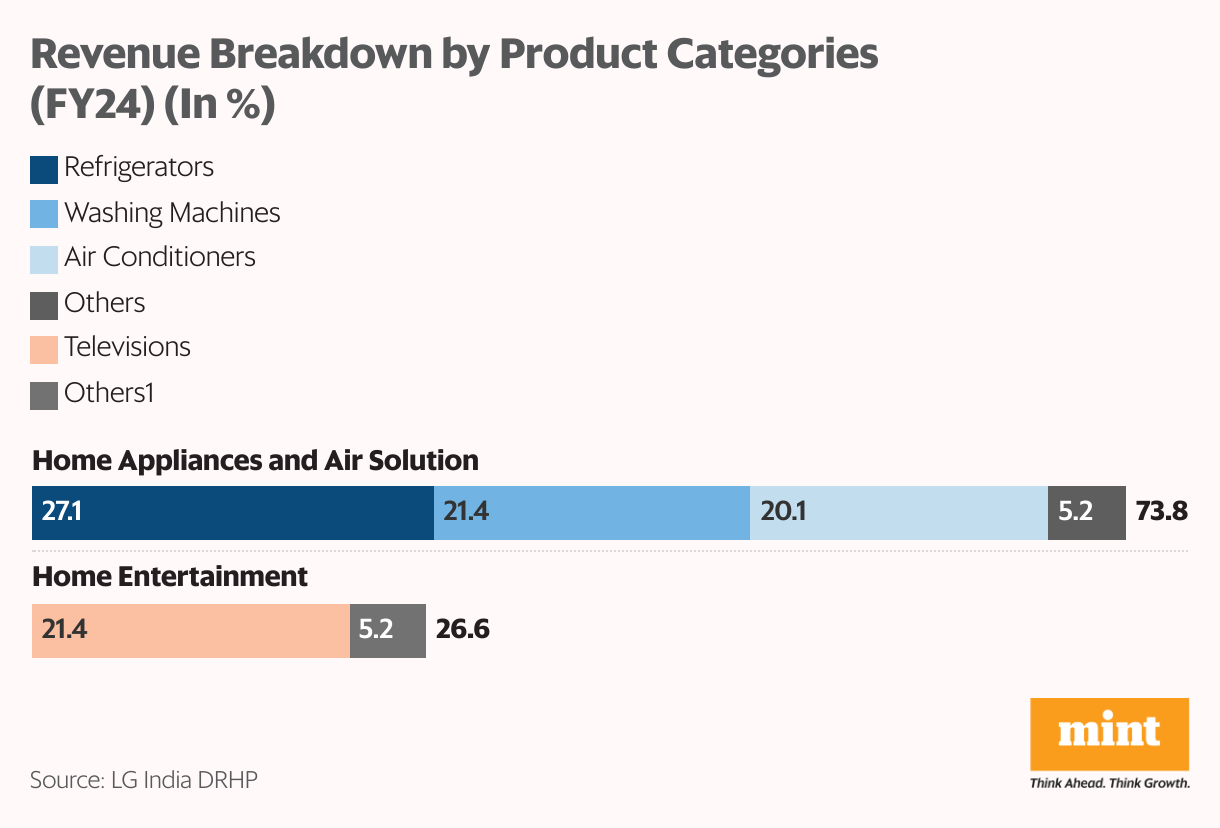

LG India’s business is split into two segments: home appliances and air solutions, which account for 73.4% of total revenue, and home entertainment, contributing 26.6% as of FY24.

Within the home appliances and air solutions segment, refrigerators bring in 27% of revenue, followed by washing machines at 21% and air conditioners at 20%. In the home entertainment category, televisions account for 21.4% of revenue.

LG ranks second in industry revenue behind Samsung, which reported ₹99,542 crore. However, among listed competitors, it leads with ₹21,352 crore in revenue, surpassing Havells ( ₹18,590 crore), Voltas ( ₹12,481 crore), and Blue Star ( ₹9,683 crore).

Over FY22-24, LG’s revenue grew at an annual rate of 12.2%, but this momentum has slowed. Year-on-year growth declined from 17% in FY23 to 7.5% in FY24, while competitors continued to expand at a stronger pace.

Despite lagging in revenue growth, LG outperforms in profitability. Its profit rose at an annual rate of 13.5% to ₹1,511 crore over the same period, outpacing Havells, which posted a modest 3% growth, and Voltas, which saw negative growth. However, it trailed Blue Star, which recorded a steep 57% increase in profits over two years.

LG’s strong earnings are backed by an industry-leading Ebitda margin of 10.4%, nearly 50% higher than the sector average of 7%. Its in-house manufacturing and favorable product mix contribute to better margins than its peers, with Havells at 9.9%, Blue Star at 6.9%, and Voltas at just 2.7%. While LG slightly trails Havells in gross margins, its higher Ebitda margin reflects better operational efficiency and cost control.

This profitability advantage translates into a robust return on capital employed (RoCE) of 45.3%, well ahead of Havells (19.4%), Blue Star (19.8%), and Voltas (4.4%).

For more such analyses, read Profit Pulse.

With strong margins and efficient capital deployment, LG is positioned to generate superior returns for investors despite slowing revenue growth.

Will the valuation leave enough on the table for investors?

With market estimates pegging LG India’s valuation at around $15 billion, the company is expected to list at a price-to-earnings multiple of 85, placing it at a premium compared to Blue Star (82), Voltas (69), and Havells (67).

While its market leadership, diversified product portfolio, strong profitability, and healthy margins may justify a higher valuation, even a more conservative assessment suggests limited upside for investors at current levels.

A key concern is LG’s rising royalty payments to its South Korean parent, LG Electronics Inc. The company paid 1.5% of its revenue as royalty in FY22, which increased to 1.6% in FY23 and 1.8% in FY24. This upward trend could weigh on shareholder returns, mirroring concerns seen with Hyundai.

Read this | There’s a case for heavy taxes on royalties that MNC units pay their parents

That said, the IPO comes at a time when India’s consumer electronics market is poised for strong growth. Rising per capita income, urbanization, premiumization, greater penetration, and replacement demand are expected to drive the sector at a 12% CAGR from FY24 to FY28.

With its market dominance and operational strength, LG India is well-positioned to capitalize on this expanding opportunity. While the valuation appears stretched, its long-term growth potential makes it a company worth watching.

Note: Throughout this article, we have relied on data from LG India DRHP. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

About the author: Madhvendra has been a passionate follower of the equity market for over seven years. He is a seasoned financial content writer. He loves reading and sharing his opinion about listed Indian companies and macroeconomics.

Disclosure: The writer does not hold the stocks discussed in this article.