Franklin Templeton has filed to launch an exchange-traded fund based on Ripple’s XRP, joining Bitwise, Canary Capital, and others in the XRP ETF race.

Franklin Templeton has filed to launch Ripple (XRP) ETFs, tracking its spot price minus fees. The ETF shares will be traded on the Cboe BZX exchange, while Coinbase will act as the custodian. ETF holders won’t receive any benefits from XRP-related forks or airdrops.

By filing for Ripple ETFs, CBOE joins Bitwise, 21Shares, WisdomTree, CoinShares, Canary Capital, and Grayscale Investments in the race to launch XRP-based investment products. The U.S. Securities and Exchange Commission (SEC) has already acknowledged the proposals from these firms and is in the process of making approval decisions. It’s also important to note that the S.E.C. delayed its decision on Grayscale’s XRP ETFs, pushing it until May.

According to Bloomberg analysts, XRP ETFs have 65% chance of approval, making it less likely than Litecoin (LTC), Solana (SOL), and even Dogecoin (DOGE).

However, they released their odds back in February, meaning they didn’t account for the recent development. Specifically, the legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) might be wrapping up, according to FOX Business journalist Eleanor Terrett.

https://twitter.com/EleanorTerrett/status/1899852341374779587

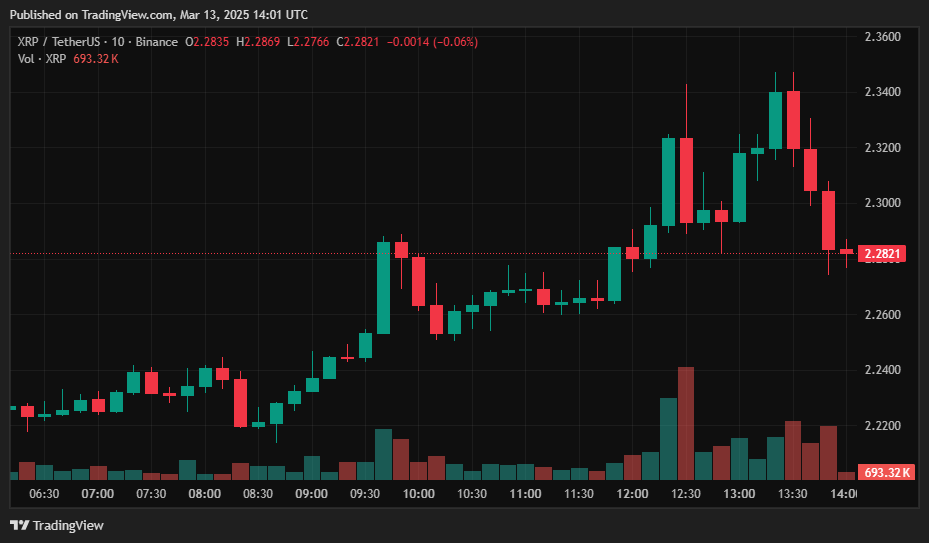

The market’s reaction to this scoop reflected a classic case of buy the rumor, sell the news. On the initial reports of XRP case potentially nearing conclusion, XRP price rose by 4% over the past 24-hour period, but after the hype cooled and no more news followed, a wave of selling pressure kicked in, as evident from the four consecutive bearish candles on the shorter timeframe chart.

With the prolonged Ripple lawsuit potentially nearing resolution, especially given the SEC’s recent dismissal of lawsuits against other crypto firms, the approval of XRP ETFs feels increasingly likely. The case was likely the main impediment to Ripple-based ETFs, as it created regulatory uncertainty around the status of XRP as a security. If this regulatory hurdle is finally removed, the arrival of XRP ETF shift could shift from speculation to reality, potentially setting the stage for a more sustained XRP price movement. Plus, the entry of Franklin Templeton on the XRP ETF race is another good sign, suggesting that they see a decent chance of approval.