Ethereum’s price has crashed more than 53% from its 2024 high, wiping out $255 billion in market value as its market cap fell from $482 billion to $227 billion.

Ethereum (ETH) has dropped as concerns about the network continued. On Monday, analysts at Standard Chartered lowered their ETH price target from $10,000 to $4,000, citing the structural decline of the network.

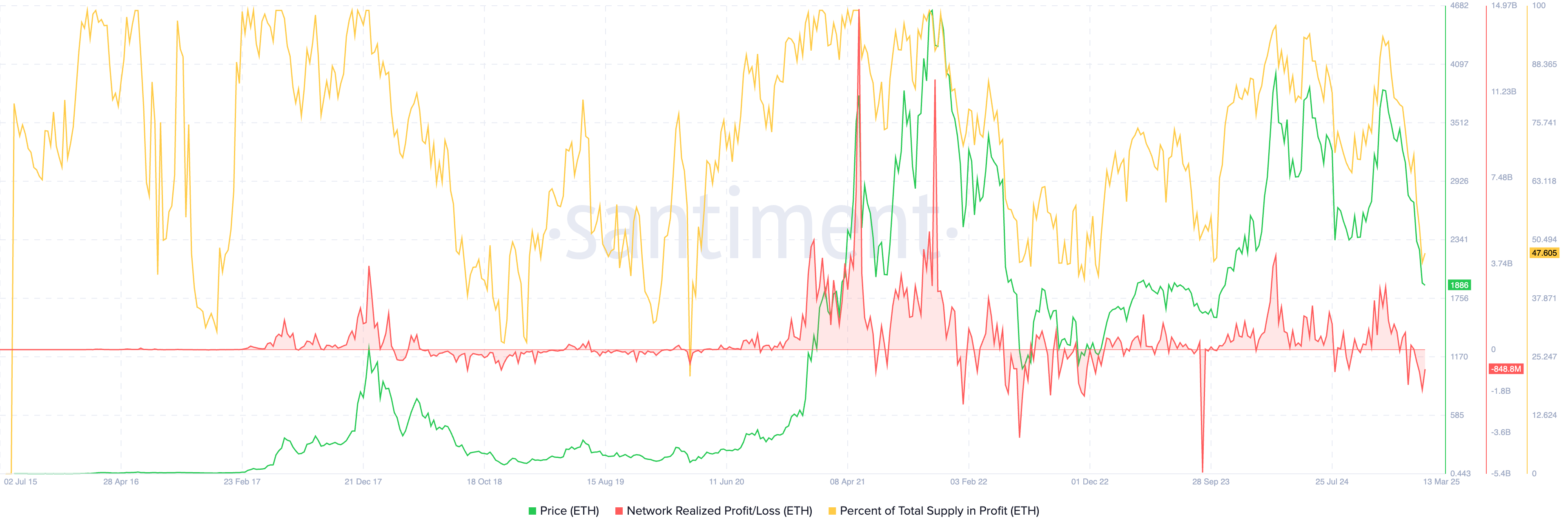

Many Ethereum investors have suffered losses during the ongoing crash. According to Santiment data, the percentage of total Ethereum supply in profit has dropped to 47.6% — its lowest level since October 2023. The network’s realized loss has also hit its lowest point in nearly two years.

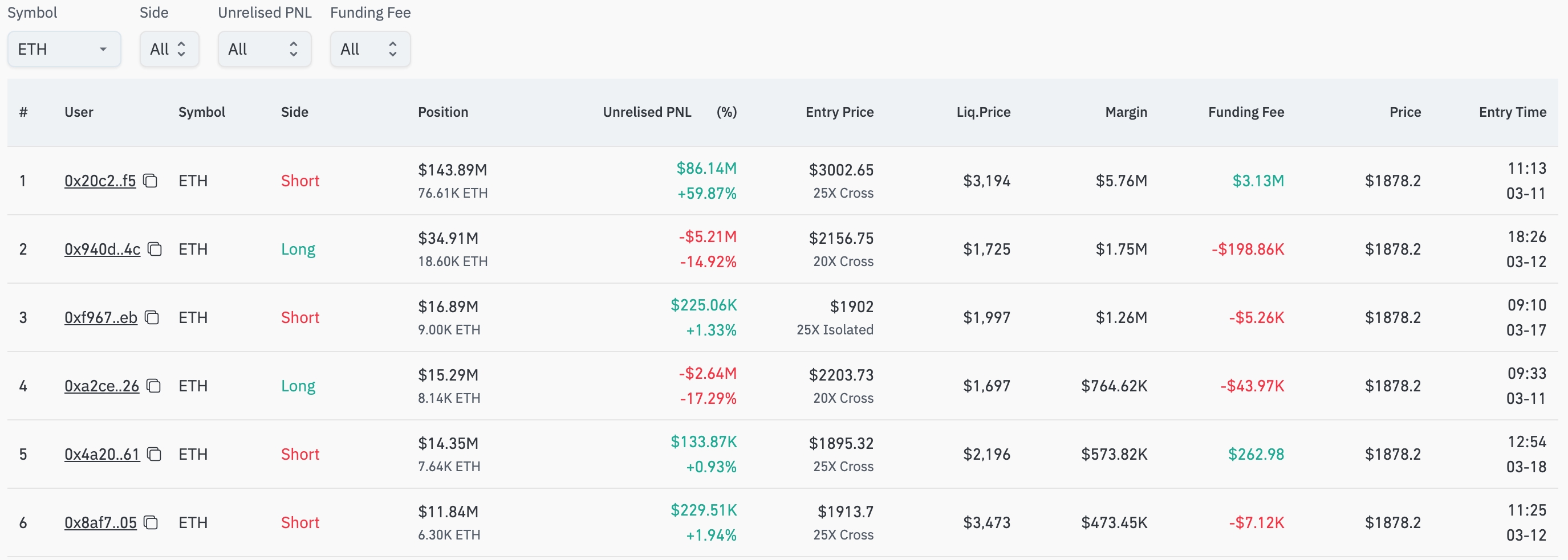

Not everyone is losing money on Ethereum. CoinGlass data shows that one trader made $86 million shorting ETH on Hyperliquid. The trader placed a $143 million short trade on March 3 when Ethereum was trading at $3,000.

By applying 25x leverage, the trader has profited as ETH plunged to $1,878 on Tuesday. His funding fee was $3.13 million, and his margin was $5.76 million. His position will be liquidated if Ethereum rebounds to $3,194.

Meanwhile, another trader lost $5.21 million by going long on Ethereum. This trader bought 18.6 ETH and applied 20x leverage. His trade will be liquidated if ETH drops to $1,725.

Ethereum price technical analysis

Technicals suggest that the Ethereum short-seller may remain profitable, as indicators point to further downside.The daily chart shows that Ethereum remains below the key support at $2,135 — the neckline of a triple-top pattern at $4,000.

Ethereum price has formed a death cross pattern as the 50-day and 20-day moving averages flipped each other in February.

The coin is now forming a bearish pennant pattern, consisting of a long vertical line and a symmetrical triangle. The triangle is nearing its confluence point, suggesting that a bearish breakout could push Ethereum down to the psychological level of $1,500 — about 20% below its current price.