Chainlink price stabilizes as technicals and fundamentals signal a rebound.

Chainlink (LINK) was trading at $18.80 on Monday, up 20% from its lowest level last week as the recent sell-off eased.

LINK has several catalysts that may drive its price higher in the long term. It is the largest oracle provider in the crypto industry, offering solutions to major decentralized finance players such as AAVE and Compound.

Chainlink has also become a key player in the real-world asset tokenization industry through its cross-chain interoperability protocol. CCIP is a secure interoperability network that enables token transfers and messaging across multiple chains.

Additionally, Chainlink has forged partnerships with major financial services companies. It has a collaboration with Swift, a network that moves trillions of dollars annually, and other partnerships with firms like UBS, Coinbase, and Emirates NBD.

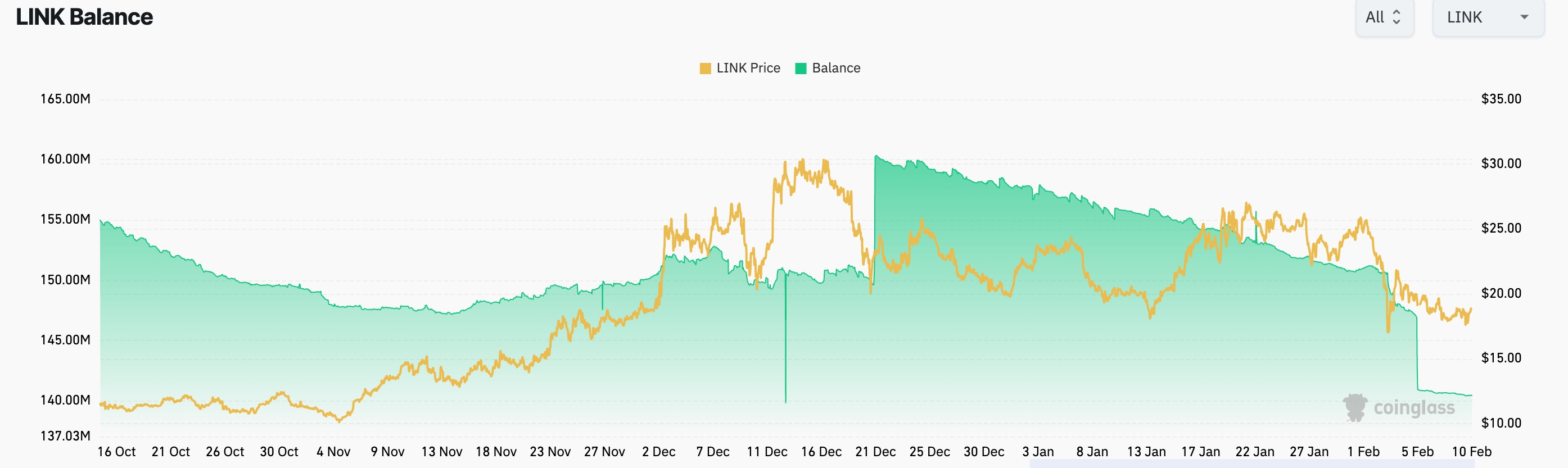

A new catalyst may soon push Chainlink’s price higher. LINK balances on exchanges have dropped in recent weeks, with 140 million LINK tokens currently held on exchanges tracked by Coinglass, down from 150 million in December.

Declining exchange balances suggest that investors are holding onto the token, which is a bullish indicator. It also signals rising demand for Chainlink’s staking services. Over 40.87 million LINK tokens are currently staked, with a yield of 4.32%.

Chainlink price forecast

The daily chart shows that LINK peaked at $31 in December before bottoming at $16 last week. This bottom coincided with the 61.8% Fibonacci retracement level and the 200-day Exponential Moving Average, indicating strong support and hesitation from bears to short below this level.

Chainlink’s price has also formed a bullish flag pattern, a well-known continuation signal. It is now attempting to break above the key resistance level at $19.12, its highest swing in May last year.

Therefore, the token is likely to rebound and retest the next major resistance level at $25.60, the 23.6% retracement level, which is approximately 35% above the current price.