The past week or so has gone without any major fireworks in either direction, unlike the events from the previous one, and BTC remains stuck at around $84,000.

However, the cryptocurrency doesn’t tend to stay steady for long, so this could be simply the calm before the storm.

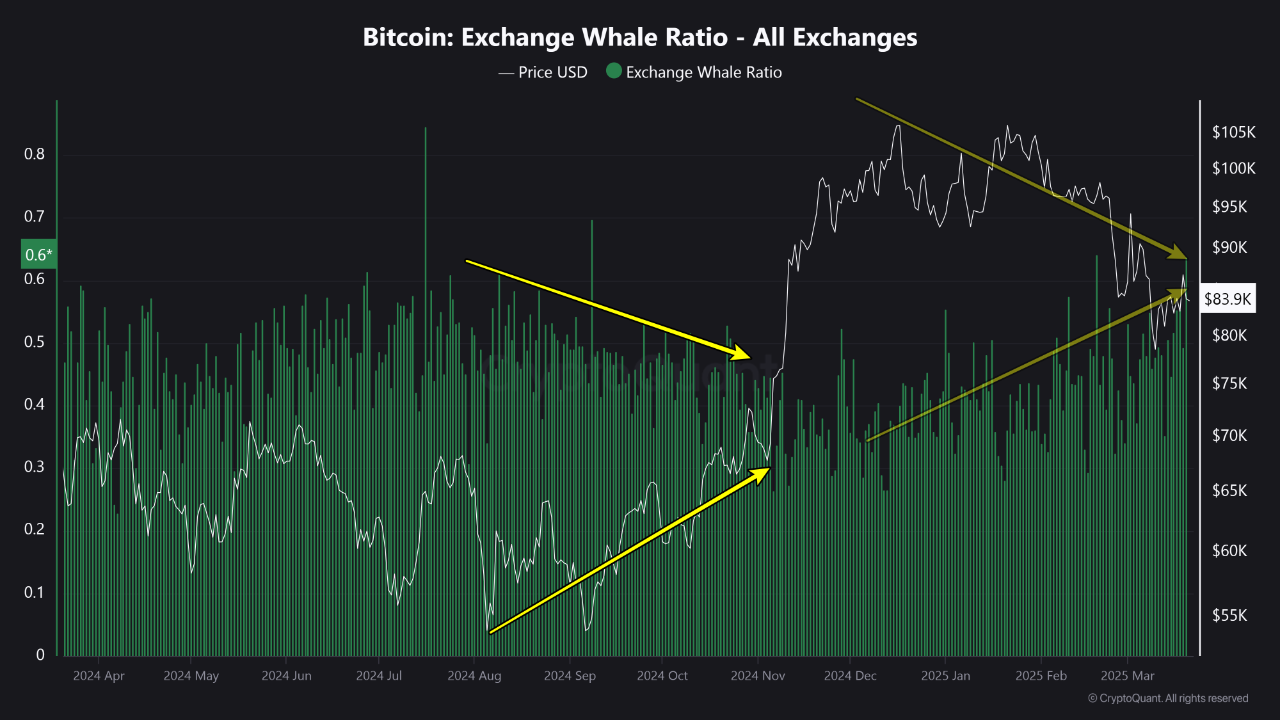

Whale Activity Warning

As we have explained numerous times in the past, whales play a highly important role in the cryptocurrency market as they control a large portion of BTC and most altcoins. Their decisions on whether to buy big portions or sell them could become a domino effect and lead to substantial price movements in either direction.

Data from CryptoQuant shows some warning signs in regards to bitcoin on that front. The BTC Exchange Whale Ratio, a metric calculated as the ratio of the top 10 inflows to the total inflows on crypto trading platforms, has gone into “levels not seen since last year.”

The company’s analysis suggests that a “substantial portion of Bitcoin deposits” into exchanges is “being driven by large holders or whales.” Consequently, the report indicated that this behavior is “often interpreted as these big players actively reallocating their assets, potentially signaling forthcoming selling pressure in the market.”

STHs Underwater

The other somewhat worrying news on the BTC price front is the growing number of Short-Term Holders (STHs) that are sitting on substantial unrealized losses. Glassnode asserted that this cohort of investors has holdings worth $7 billion, which are underwater.

This is the largest sustained loss event of this cycle. However, it remains within “historical bull market bounds” and is still less painful than those seen during the May 2021 sell-off. During the end of that bull cycle four years ago and in the subsequent bear market, these losses skyrocketed to somewhere between $19.8 billion and $20.7 billion.

The rolling 30-day realized loss for #Bitcoin‘s STHs has reached $7B, marking the largest sustained loss event of this cycle. However, this remains well below prior capitulation events, such as the $19.8B and $20.7B losses in 2021-22: https://t.co/SoUZfmHaX2 pic.twitter.com/eSUJjfYiEf

— glassnode (@glassnode) March 21, 2025

STHs are typically the first to exit the market when prices tend to head south or remain in a consolidation phase for a while, especially when they are underwater. As such, BTC could plunge further if they decide to dispose of some (or all) of their bitcoin holdings.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!