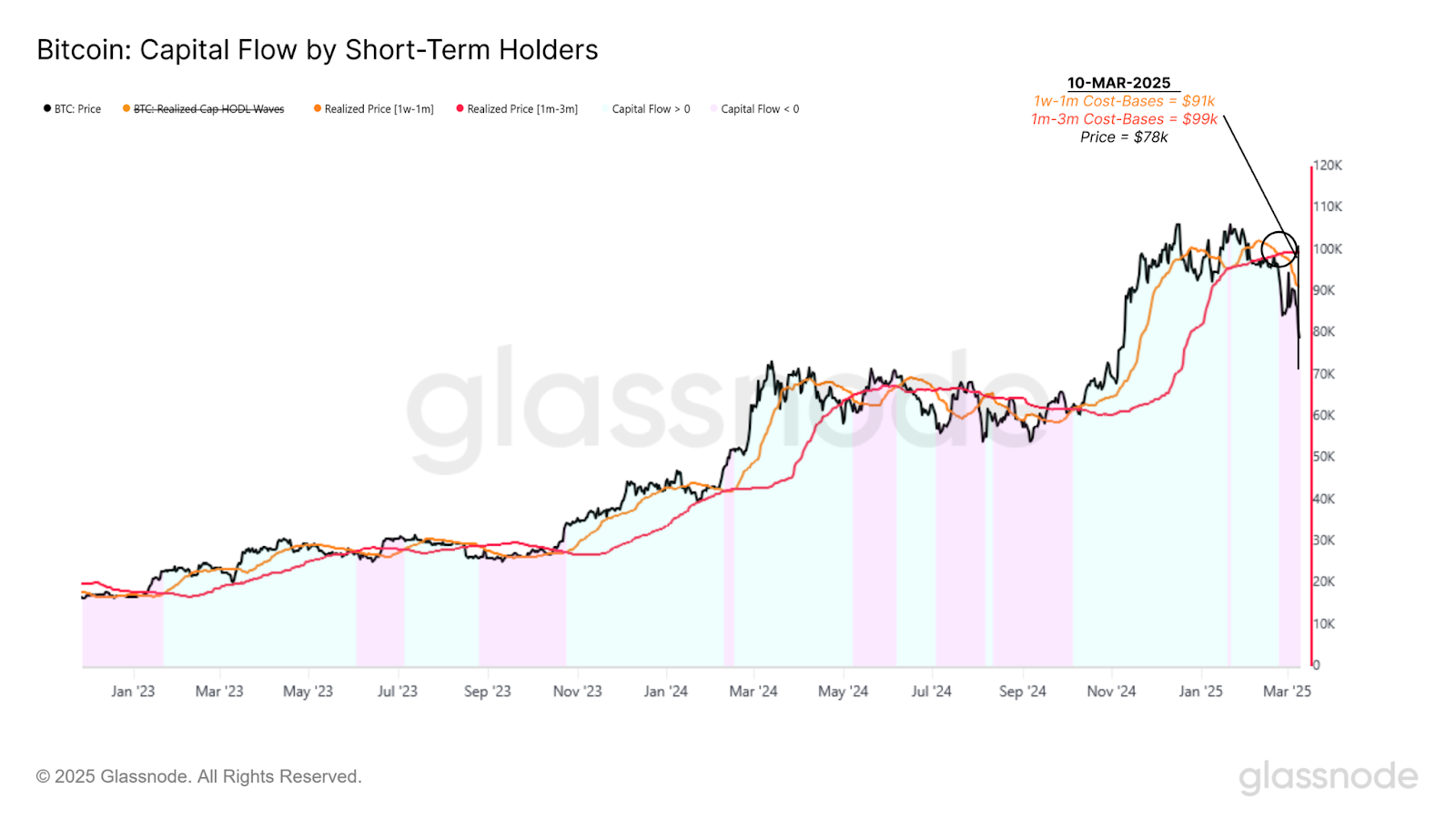

Bitfinex analysts said Bitcoin buyers with purchases in the last month were the hardest hit during recent crypto market selloffs.

Bitcoin (BTC) shed 13.5% of its value in the past 30 days and has dropped over 29% from its all-time high set in January, the biggest correction of the current bull cycle, according to the Bitfinex Alpha Report released on March 17.

Past cycles witnessed similar drawdowns ranging from 30% to 50%. However, some expected a different outcome this time due to new institutional adoption through spot BTC exchange-traded funds on Wall Street.

U.S. spot BTC ETFs recorded a blitz to over $100 billion in assets under management within a year, as issuers like BlackRock and Fidelity attracted massive capital inflows.

Short-term Bitcoin holders capitulating

Cash allocated to these EFTs has trickled down over the past few weeks, while consecutive outflows have now set records. Last week, nearly $1 billion exited these products, signaling that “institutional buyers have not yet returned with sufficient strength to counteract selling pressure,” Bitfinex analysts wrote.

Tepid price action has also rattled crypto sentiment. Indicators like the Fear & Greed index dropped to multi-year lows, “exacerbating sell-side pressure” as short-term holders capitulated, according to the Bifiniex report.

Data from IntoTheBlock supported the assertion from Bitfinex analysts. The “Global In/Out of the Money” metric showed 20% of all BTC holders in unrealized losses. Most of these buyers purchased their Bitcoin between $85,700 and $106,800 per IntoTheBlock.

Historically, when fresh capital inflows slow and cost basis trends shift, it signals a weakening demand environment. This trend has become increasingly evident as Bitcoin struggles to hold above key levels. Without new buyers stepping in, Bitcoin risks extended consolidation, or even further downside as weaker hands continue to exit their positions.

Bitfinex analysts

Possible turn around

Further downside price action may also ensue as financial markets digest the result of Trump’s tariffs and U.S. macro data.

While inflation cooled and the jobs market showed signs of resilience, a rise in underemployment and macro uncertainty incentivized a hands-off approach from many investors. However, Bitfinex analysts believe a bullish outcome remains possible if the right factors align.

The key factor to watch is whether long-term holders or institutional demand re-emerge at these lower levels. If deeper-pocketed investors begin absorbing supply, it could signal a shift back toward accumulation, potentially stabilizing price action and reversing sentiment.