Shiba Inu, the second-biggest meme coin, has stabilized as outflows from centralized exchanges continued and whale activity increased.

Shiba Inu (SHIB) rose to $0.000018, bringing the seven-day gains to 26.4% and its market cap to over $10.8 billion.

Its strength coincided with that of other meme coins like Mog Coin (MOG), Pepe (PEPE), and Dogwifhat (WIF), which have all jumped by over 30% in the last seven days.

On-chain data shows Shibarium’s network has reversed most of the gains made last week. According to Shibariumscan, the average transaction fee in Shibarium dropped to 0.0025 BONE, down from last week’s high of 0.054 BONE.

Additional data shows daily additions have decreased, while the cumulative number of Shibarium accounts has grown to a record high of 126,750. Last week saw 470 new accounts added, down from the high of 3,200 seen last month.

Shibarium’s activity is important for Shiba Inu because a portion of the BONE generated in the ecosystem is converted into SHIB and burned.

On the positive side, there are signs that investors are bullish on Shiba Inu. Data from Nansen shows that SHIB’s CEX outflows continued this week, with net outflows worth over $2.7 million in the last 24 hours. The total tokens on exchanges have dropped by 0.3% in the last seven days to over 254.2 trillion, equivalent to $4.5 billion.

An outflow from centralized exchanges is often seen as positive since it suggests that investors are moving their coins to self-custody.

Meanwhile, data by Santiment shows Shiba Inu has experienced a significant increase in whale activity as most of them bought the dip. Other tokens with notable activity include Injective, Wrapped Bitcoin, and Maker DAO.

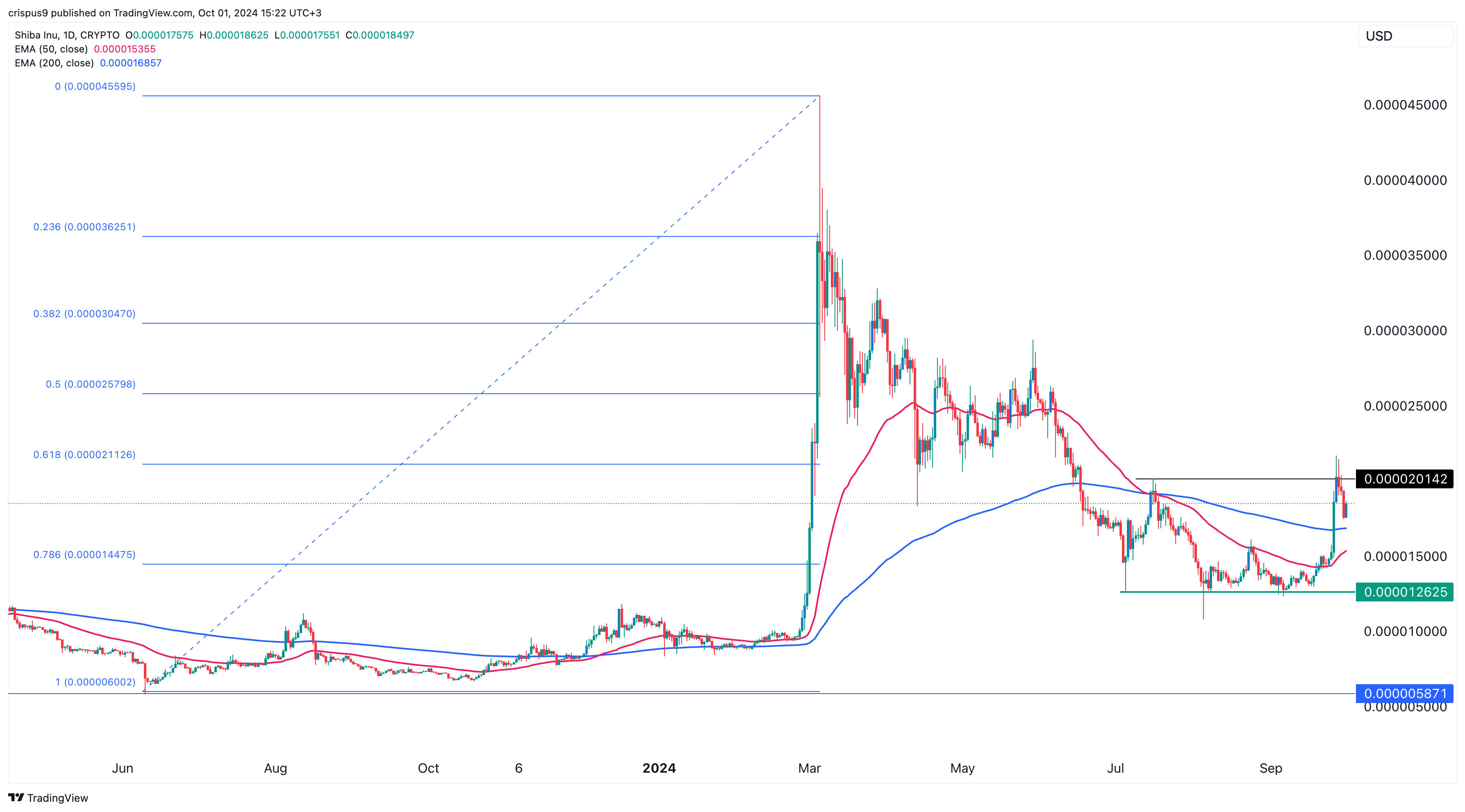

Shiba Inu steady above key moving averages

Shiba Inu bounced back last week, reaching a multi-month high of $0.000025. It then pulled back as the recent crypto bull run faded, crossing below the key support level at $0.000020, its highest swing on July 17. SHIB also dropped below the 61.8% retracement level.

However, it has remained above the 50-day and 200-day moving averages, suggesting that the recent recovery may remain intact. More upside will be confirmed if the coin rises and flips the resistance at $0.000020 into a support level.